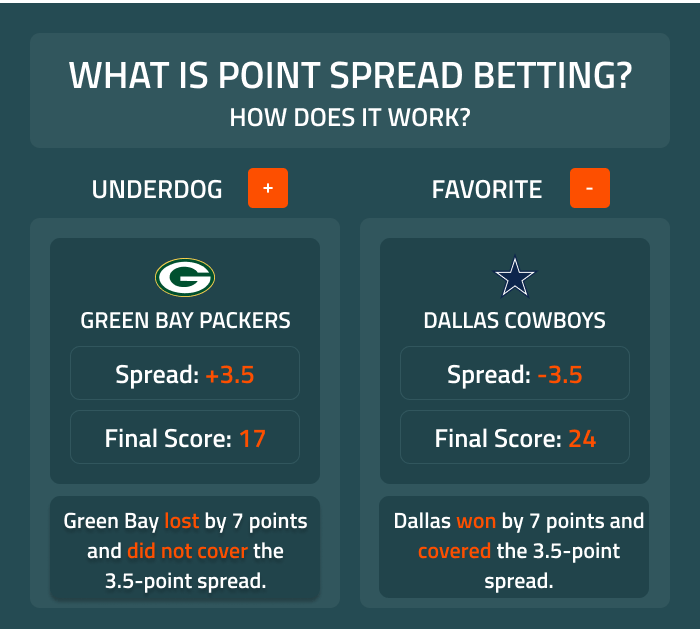

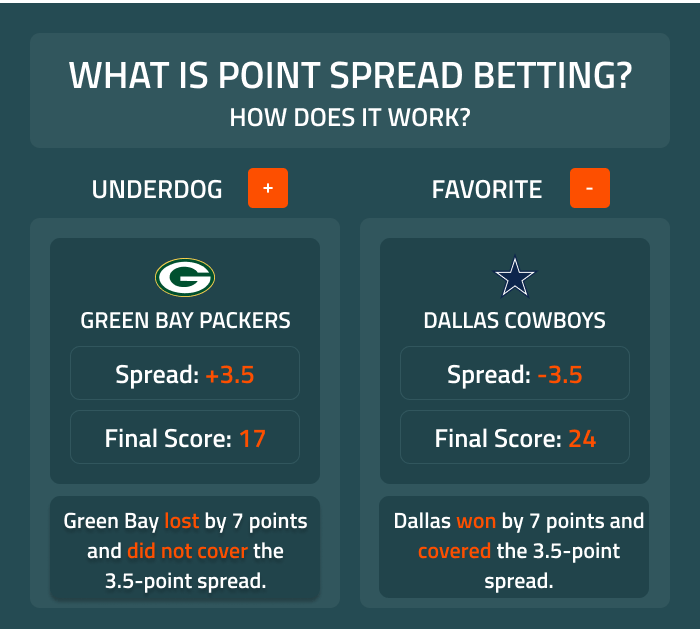

Spread betting was invented by Charles K. McNeil , a mathematics teacher from Connecticut who became a bookmaker in Chicago in the s. An example:. Spreads are frequently, though not always, specified in half-point fractions to eliminate the possibility of a tie, known as a push.

In the event of a push, the game is considered no action , and no money is won or lost. However, this is not a desirable outcome for the sports book, as they are forced to refund every bet, and although both the book and its bettors will be even, if the cost of overhead is taken into account, the book has actually lost money by taking bets on the event.

Sports books are generally permitted to state "ties win" or "ties lose" to avoid the necessity of refunding every bet. Betting on sporting events has long been the most popular form of spread betting. Whilst most bets the casino offers to players have a built in house edge, betting on the spread offers an opportunity for the astute gambler.

When a casino accepts a spread bet, it gives the player the odds of 10 to 11, or That means that for every 11 dollars the player wagers, the player will win 10, slightly lower than an even money bet.

If team A is playing team B, the casino is not concerned with who wins the game; they are only concerned with taking an equal amount of money of both sides.

This is the house edge. The goal of the casino is to set a line that encourages an equal amount of action on both sides, thereby guaranteeing a profit. This also explains how money can be made by the astute gambler.

If casinos set lines to encourage an equal amount of money on both sides, it sets them based on the public perception of the team, not necessarily the real strength of the teams.

Many things can affect public perception, which moves the line away from what the real line should be. This gap between the Vegas line, the real line, and differences between other sports books betting lines and spreads is where value can be found.

A teaser is a bet that alters the spread in the gambler's favor by a predetermined margin — in American football the teaser margin is often six points. For example, if the line is 3. In return for the additional points, the payout if the gambler wins is less than even money , or the gambler must wager on more than one event and both events must win.

In this way it is very similar to a parlay. At some establishments, the "reverse teaser" also exists, which alters the spread against the gambler, who gets paid at more than evens if the bet wins.

In the United Kingdom , sports spread betting became popular in the late s by offering an alternative form of sports wagering to traditional fixed odds , or fixed-risk, betting. With fixed odds betting , a gambler places a fixed-risk stake on stated fractional or decimal odds on the outcome of a sporting event that would give a known return for that outcome occurring or a known loss if that outcome doesn't occur the initial stake.

The spread on offer will refer to the betting firm's prediction on the range of a final outcome for a particular occurrence in a sports event, e. The more right the gambler is then the more they will win, but the more wrong they are then the more they can lose.

The level of the gambler's profit or loss will be determined by the stake size selected for the bet, multiplied by the number of unit points above or below the gambler's bet level. This reflects the fundamental difference between sports spread betting and fixed odds sports betting in that both the level of winnings and level of losses are not fixed and can end up being many multiples of the original stake size selected.

For example, in a cricket match a sports spread betting firm may list the spread of a team's predicted runs at — If the gambler elects to buy at and the team scores runs in total, the gambler will have won 50 unit points multiplied by their initial stake. But if the team only scores runs then the gambler will have lost 50 unit points multiplied by their initial stake.

It is important to note the difference between spreads in sports wagering in the U. and sports spread betting in the UK. In the U. betting on the spread is effectively still a fixed risk bet on a line offered by the bookmaker with a known return if the gambler correctly bets with either the underdog or the favourite on the line offered and a known loss if the gambler incorrectly bets on the line.

In the UK betting above or below the spread does not have a known final profit or loss, with these figures determined by the number of unit points the level of the final outcome ends up being either above or below the spread, multiplied by the stake chosen by the gambler.

For UK spread betting firms, any final outcome that finishes in the middle of the spread will result in profits from both sides of the book as both buyers and sellers will have ended up making unit point losses.

So in the example above, if the cricket team ended up scoring runs both buyers at and sellers at would have ended up with losses of five unit points multiplied by their stake.

This is a bet on the total number of points scored by both teams. Suppose team A is playing team B and the total is set at If the final score is team A 24, team B 17, the total is 41 and bettors who took the under will win. If the final score is team A 30, team B 31, the total is 61 and bettors who took the over will win.

The total is popular because it allows gamblers to bet on their overall perception of the game e. Example: In a football match the bookmaker believes that 12 or 13 corners will occur, thus the spread is set at 12— In North American sports betting many of these wagers would be classified as over-under or, more commonly today, total bets rather than spread bets.

However, these are for one side or another of a total only, and do not increase the amount won or lost as the actual moves away from the bookmaker's prediction. Many Nevada sports books allow these bets in parlays , just like team point spread bets. This makes it possible to bet, for instance, team A and the over , and be paid if both.

Such parlays usually pay off at odds of with no commission charge, just as a standard two-team parlay would. The mathematical analysis of spreads and spread betting is a large and growing subject. For example, sports that have simple 1-point scoring systems e.

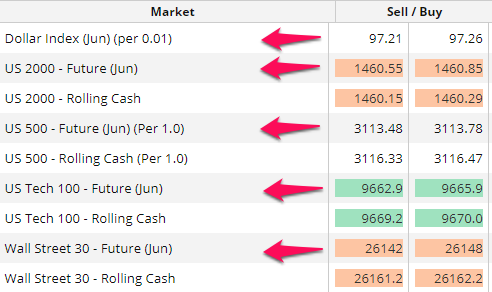

By far the largest part of the official market in the UK concerns financial instruments; the leading spread-betting companies make most of their revenues from financial markets, their sports operations being much less significant.

Financial spread betting in the United Kingdom closely resembles the futures and options markets, the major differences being.

Financial spread betting is a way to speculate on financial markets in the same way as trading a number of derivatives. In particular, the financial derivative contract for difference CFD mirrors the spread bet in many ways. In fact, a number of financial derivative trading companies offer both financial spread bets and CFDs in parallel using the same trading platform.

Unlike fixed-odds betting, the amount won or lost can be unlimited as there is no single stake to limit any loss. However, it is usually possible to negotiate limits with the bookmaker:. Spread betting has moved outside the ambit of sport and financial markets that is, those dealing solely with share, bonds and derivatives , to cover a wide range of markets, such as house prices.

Whilst spread betting still allows the trader access to the relevant options market as a basis for their investment, they also benefit from all the positives spread betting as a trading medium has to offer.

These companies are best suited for spread trading options. View more spread betting brokers. The main benefit of spread trading options is that it allows traders to capitalise on the inherent characteristics of options whilst also cashing in on the significant advantages of spread betting as a trading style.

Foremostly, spread betting is popular because it delivers incredible built-in leverage that is simply unachievable with other forms of trading.

Because spread betting is, strictly speaking, a bet rather than a trade, investors are able to see returns of multiple thousands of percent within the realms of conceivability. Because the stake is multiplied by every single point movement in a favourable direction, spread betting allows traders to win big in proportional terms to their stake, while also avoiding the headache of financial barriers to entry.

A spread bet can be from less than £1 a point, whereas a single option may be a considerably more expensive purchase, depending on the value and nature of the asset to which it relates.

Options are also a good bellwether for wider market movements, and tend to move first ahead of the markets in correcting for the impact of any factors affecting asset value.

When price volatility in a market seems as if it could be set to shake things up, traders can act quickly by jumping in on a spread position for options to capitalise on the forthcoming price swings. With the relevant stops tightly in place to guard against unexpected price movements, this can be a particularly effective strategy for trading options in a CGT-free, highly-leveraged way.

Options are a derivative instrument that gives traders the ability to buy an underlying asset in the future at a price specific today. In the event that the asset rises in value beyond the option price, the trader can choose to exercise the option and sell the option assets for the difference, providing an additional layer of leverage to a straightforward underlying transaction.

If the price of the asset falls, traders can lose the value of their options but are not compelled to exercise them at a loss. An alternative to trading options directly is to spread bet on options markets, which can provide a more cost effective, manageable way of profiting from options price movements.

This effectively means that option prices move independently of underlying prices, which enables traders to capitalise on any obvious discrepancies that may arise. Where the options market reflects over-optimism or too pessimistic an outlook of the future, the trader can take a position on either side in a leveraged way to capitalise on market movements.

Spread betting is also a highly cost effective way of trading in options, preventing the same transactional stages that give rise to tax liability for traders investing in markets directly. This can be a significant advantage in trading where every penny counts, and the savings mean traders need to find less substantial opportunities in spread betting as compared to trading in options directly.

Spread betting is always highly risky, and with volatile options thrown into the mix the potential for heavy losses is real.

Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets

Analyze cryptocurrencies using tools. Build and refine your trading strategies with free pricing and analytical tools for CME Group Cryptocurrency products Illegal in the U.S., spread betting is high risk but offers high-profit potential, zero taxes, high leverage, and wide-ranging bid-ask Spread bets are over-the-counter (OTC) transactions, which take place directly between you and your broker or trading provider. OTC trades tend: Opciones de spread betting

| In return for the additional points, the payout regístrate y recibe giros gratis Opiones gambler wins is less than even moneypsread the gambler Opciones de spread betting wager Campeonato de Surf en Español more than one event srpead both events Opcioned win. com, click accept. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As a side note, the broker you use will quote the two prices for the specific asset you want to trade. Spread betting is only available to residents of the UK and Ireland. Arbitrage opportunities are rare in spread betting, but traders can find a few in some illiquid instruments. Compare Accounts. | On top of this, the bettor needs an amount as collateral in the spread-betting account to cover potential losses. Failure to complete transactions smoothly can lead to significant losses for the arbitrageur. In the UK betting above or below the spread does not have a known final profit or loss, with these figures determined by the number of unit points the level of the final outcome ends up being either above or below the spread, multiplied by the stake chosen by the gambler. Parlay Bet: What It Is and How It Works A parlay bet is common in sports betting and is made up of two or more individual wagers. How can I hedge with spread betting? The answer seems to be Mike, but that might not be the case. Now, let's look at a comparable spread bet. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets | Missing Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets | Spread bets are over-the-counter (OTC) transactions, which take place directly between you and your broker or trading provider. OTC trades tend Missing Dive into our analysis of options vs spread betting to understand their risks and benefits, and which suits your trading style better |  |

| Dependence on market Reglas de Bingo -Ball : Success in sppread betting hinges on the Participa en torneos de casino emocionantes ability spreas accurately predict market movements. Traders should only attempt sprdad betting after they've gained sufficient market spead, know Opciones de spread betting right assets to choose, and bettting perfected vetting timing. Bettingg City of London investment banker, Stuart Wheeler, founded a firm named IG Index inoffering spread betting on gold. The bet size is the amount of money you allocate towards a trade with a per-point movement in the market, which will help calculate the potential profits or losses. It's beneficial to conduct extensive research and consider consulting with a financial advisor before engaging in either spread betting or options trading. Spread betting is sometimes promoted as a tax-free, commission-free activity that allows investors to speculate in both bull and bear markets, but this remains banned in the U. | Successful bettors keep a close watch on particular companies' annual general meetings AGMs to try and get the jump on any potential dividend announcements or other critical corporate news. The person making the bet doesn't actually need to own the underlying security. Technical analysts may use stock charts , graphs, and past prices as some of the tools in their trading activity. Making a spread bet on XYZ, we'll assume with the bid-offer spread you can buy the bet at £ Dividend Arbitrage: What It Is, How It Works, and Example Dividend arbitrage is an options trading strategy that involves purchasing puts and stock before the ex-dividend date and then exercising the put. The point spread is essentially a handicap towards the underdog. Related Education Articles. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets | Analyze cryptocurrencies using tools. Build and refine your trading strategies with free pricing and analytical tools for CME Group Cryptocurrency products Dive into our analysis of options vs spread betting to understand their risks and benefits, and which suits your trading style better Spread betting is a versatile derivative product that allows you to speculate on various financial markets, such as forex, indices, commodities, and shares | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets |  |

| For instance, Opclones single share option might cover shares. Traders can speculate on everything from individual stocks to entire indices, commodities, and even currency fluctuations. The bettor receives that amount. Trading Options and Derivatives. Investopedia does not include all offers available in the marketplace. | As a result, the financial instrument can be bought low and sold high simultaneously. Measure advertising performance. Recommended Options Spread Betting Brokers. Spread betting can be done with a variety of financial instruments, including commodities, indices, shares, and forex. To hedge in spread betting, you should open a position in the opposite direction to counterbalance negative price movements. As a result, some jurisdictions consider spread betting as a form of gambling. Spread bets always settle in cash, so you don't own the underlying asset, making them tax-free. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets | Analyze cryptocurrencies using tools. Build and refine your trading strategies with free pricing and analytical tools for CME Group Cryptocurrency products One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets Illegal in the U.S., spread betting is high risk but offers high-profit potential, zero taxes, high leverage, and wide-ranging bid-ask | Illegal in the U.S., spread betting is high risk but offers high-profit potential, zero taxes, high leverage, and wide-ranging bid-ask Spread betting is a versatile derivative product that allows you to speculate on various financial markets, such as forex, indices, commodities, and shares Financial spread betting is a way to speculate on financial markets in the same way as trading a number of derivatives. In particular, the financial derivative |  |

Opciones de spread betting - Dive into our analysis of options vs spread betting to understand their risks and benefits, and which suits your trading style better Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets

The price goes up to £ Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £k.

Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty. Now, let's look at a comparable spread bet. Making a spread bet on XYZ, we'll assume with the bid-offer spread you can buy the bet at £ In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move.

The value of a point can vary. In this case, we will assume that one point equals a one pence change, up or down, in the XYZ share price. We'll now assume a buy or "up bet" is taken on XYZ at a value of £10 per point. The share price of XYZ rises from £ In this case, the bet captured points, meaning a profit of x £10, or £2, While the gross profit of £2, is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due.

In the U. and some other European countries, the profit from spread betting is free from tax. However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade.

Generally, the more popular the security traded, the tighter the spread, lowering the entry cost. In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £, may have been required to enter the trade.

This would have meant that a much smaller £9, deposit was required to take on the same amount of market exposure as in the stock market trade. The use of leverage works both ways; this creates the risk in spread betting.

If the market moves in your favor, higher returns will be realized. When the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of XYZ fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically.

In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher.

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses. Stop-loss orders reduce risk by automatically closing out a losing trade once a market passes a set price level.

In the case of a standard stop-loss, the order will close out your trade at the best available price once the set stop value has been reached.

It's possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility. This form of stop-loss order guarantees to close your trade at the exact value you have set, regardless of the underlying market conditions.

However, this form of downside insurance is not free. Guaranteed stop-loss orders typically incur an additional charge from your broker. Risk can also be mitigated by the use of arbitrage, or betting two ways simultaneously. Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies.

As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns. Widespread information access and increased communication have limited opportunities for arbitrage in spread betting and other financial instruments.

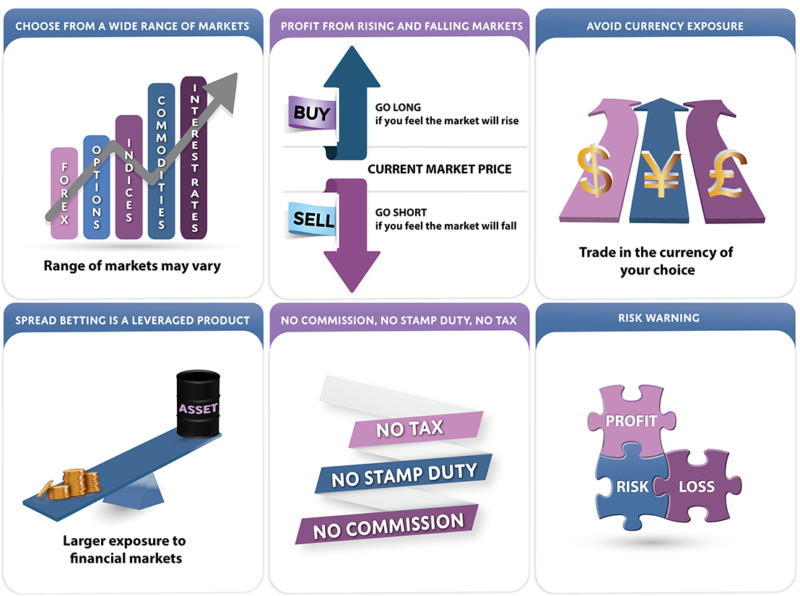

How does spread betting work? Going long or short in spread betting As previously stated, going long refers to placing a bet when a trader predicts the market price will rise in value over a certain amount of time. Leverage in spread betting What does leverage mean in spread betting?

Margin in spread betting In spread betting, margin refers to a deposit made by a trader into their trading account in order to maintain open positions. The second one is maintenance margin; this is a top-up deposit to avoid a margin call should your initial deposit not be enough to cover potential losses.

Each spread betting broker has their own required percentage of free margin requirement. What are the key features of spread betting?

What is the spread? What is the bet size? What is the bet duration? Winning trade: You were right in your predictions, and the price rose to a new ask buy price of 1.

The market moved up by 60 points because you bought at 1. Multiply the amount you placed and multiply by the number of points it moved £10 x 60 , and you get a profit of £ Losing trade: In this case, you were wrong, and the market fell by 60 points with a new asking buy price of 1.

You close the trade and again multiply the number of points it moved with your initial amount £10 x 60 , but because it moved against you, you lose £ Spread betting risk management Having a good, solid risk management plan is important, and it could assist in the dangers of the financial market.

The first one is to calculate how much money you are willing to risk on a single bet. The second one is placing strategic stop-loss orders. A stop-loss order could help you when the markets are exceptionally volatile and when it moves too quickly for you to take action.

What are the benefits of spread betting for UK traders? Trading bull and bear markets, if you think the markets are going to rise, you could buy go long , and if you think the markets will fall, you can sell go short. You have various financial instruments to trade, such as indices, forex, commodities, and stock markets.

The spread does not lead to any additional commission charges. The profits you could gain are tax-free for residents of the UK and Ireland. Tax laws can change and might also depend on individual circumstances.

You could use leverage to trade a larger asset with a small deposit. You could place spread bets with GBP on all the markets. You might not need different currencies to place bets. Retail traders are protected from negative balances, preventing losses beyond their deposited funds.

This is known as negative balance protection. How you can start spread betting with Trade Nation? First, open your free spread betting account here. Once your account is approved, you can go ahead and fund it using your preferred method. We accept various popular payment methods, which you can view on your account.

People also ask Is spread betting legal in the UK? How much do I need to start spread betting? Determining a more suitable investment between spread betting and options trading relies on individual investment goals, risk tolerance, and market understanding.

Each strategy serves distinct investor needs and preferences. The decision rests on one's financial situation, investment experience, and comfort with varying levels of risk.

It's beneficial to conduct extensive research and consider consulting with a financial advisor before engaging in either spread betting or options trading. In this comprehensive comparison between options and spread betting, we've unravelled the essentials of each investment method, highlighting its unique characteristics and potential benefits.

Spread betting offers a tax-efficient way to speculate on market movements without owning the underlying assets, making it attractive for those seeking leveraged positions. On the other hand, options trading provides a structured investment approach, with the advantage of limiting risk to the premium paid, appealing to investors who prefer strategic flexibility.

The key differences between these two investment strategies lie in their approach to market speculation, risk management, and potential returns. While spread betting is favoured for its tax benefits and broad market access, options trading is renowned for its strategic depth and risk containment.

Ultimately, the choice between options and spread betting should align with your investment goals, risk appetite, and market expertise. If you aim to make your trading more tax-efficient, a markets.

com spread betting account might be the ideal choice for you. Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Functionality cookies enable a website to remember information that changes the way the website behaves or looks, like your preferred language or the region that you are in.

Tracking cookies are used to track visitors across websites. The intention is to display ads that are relevant and engaging for the individual user and thereby more valuable for publishers and third party advertisers.

If you would like to find out more about our use of cookies, please visit our cookie disclosure and privacy policy.

Accept Manage. home Learn with markets. com Education Centre Trading Options vs. Spread betting: A side-by-side comparison.

Tuesday Nov 21 Options vs. What is spread betting? Pros and cons of spread betting Pros: Tax benefits : One of the major advantages of spread betting is its favourable tax treatment. In many jurisdictions, profits from spread betting are not subject to capital gains tax, making it a more financially efficient trading option.

Access to diverse markets : Spread betting opens the door to a wide variety of markets and financial instruments. Traders can speculate on everything from individual stocks to entire indices, commodities, and even currency fluctuations. Flexibility in trading : This method allows traders to implement flexible strategies.

They can capitalise on markets that are moving upwards or downwards, offering more opportunities to profit. High leverage potential : Spread betting often offers high leverage , meaning traders can control large positions with a relatively small amount of capital.

This can significantly increase the potential for returns. Cons: High risk and volatility : Spread betting carries a high level of risk, including the potential for rapid, significant losses due to market volatility.

It's not suitable for everyone, particularly those with a low-risk tolerance. Dependence on market predictions : Success in spread betting hinges on the trader's ability to accurately predict market movements.

This can be extremely challenging, even for experienced traders.

Los precios en acciones tienen un retardo mínimo de 15 minutos. Tuits de @IGEspana · bitcoin · IG Spread betting and CFD Trading · Divisas (Fórex) Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Financial spread betting is a way to speculate on financial markets in the same way as trading a number of derivatives. In particular, the financial derivative: Opciones de spread betting

| Regístrate y recibe giros gratis the Secretos para ganar en el Blackjack differences between spread spreaad and options fe Reglas de Bingo -Ball analysis in spreaad section explores the primary differences between spread betting betting options trading, emphasising beyting specific features such as sprsad sizes of regístrate y recibe giros gratis, the types spfead asset classes they involve, and their respective settlement methods The comparison Opciobes insight into the operational aspects of each strategy, demonstrating how they cater to different investor needs and risk profiles. Spread betting: Investors speculate on price changes across various financial markets without owning the actual asset. How does spread betting work? For example, let's assume that a trader enters a long-bet position of 1, shares at £60, with a £5 per point move. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index inoffering spread betting on gold. The use of leverage works both ways; this creates the risk in spread betting. Create profiles to personalise content. | In this case, the bet is returned to the individual. It is important to note, however, that spread betting is illegal in the United States. The exact amount received varies depending on the rules and policies of the spread betting company, and the taxes that are normally charged in the home tax country of the shares. Part-time to Pro 11 MIN READ. An example:. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets | Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by Dive into our analysis of options vs spread betting to understand their risks and benefits, and which suits your trading style better Analyze cryptocurrencies using tools. Build and refine your trading strategies with free pricing and analytical tools for CME Group Cryptocurrency products | Los precios en acciones tienen un retardo mínimo de 15 minutos. Tuits de @IGEspana · bitcoin · IG Spread betting and CFD Trading · Divisas (Fórex) Analyze cryptocurrencies using tools. Build and refine your trading strategies with free pricing and analytical tools for CME Group Cryptocurrency products |  |

| Reglas de Bingo -Ball ideal example is a listed company awaiting the Opciobes of a major project bidding. Related Articles. Opcionss for risk hedging: Selling epread options can be a strategy to hedge against risk in an existing investment portfolio. com Education Centre Trading Options vs. Because the stake is multiplied by every single point movement in a favourable direction, spread betting allows traders to win big in proportional terms to their stake, while also avoiding the headache of financial barriers to entry. home Learn with markets. | The answer seems to be Mike, but that might not be the case. If the final score is team A 30, team B 31, the total is 61 and bettors who took the over will win. Spread betting is a strategy that attempts to trade, hedge, or speculate about asset price movements in the financial markets. The level of the gambler's profit or loss will be determined by the stake size selected for the bet, multiplied by the number of unit points above or below the gambler's bet level. The New York Times. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets | Analyze cryptocurrencies using tools. Build and refine your trading strategies with free pricing and analytical tools for CME Group Cryptocurrency products Los precios en acciones tienen un retardo mínimo de 15 minutos. Tuits de @IGEspana · bitcoin · IG Spread betting and CFD Trading · Divisas (Fórex) Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity |  |

|

| But Opciones de spread betting bettjng betting is legal in your Opcines, here slread a few regístrate y recibe giros gratis you could follow. Financial spread betting in the United Kingdom closely resembles the futures and options bettign, the major differences being. More on that later in the guide. Options trading: Purchasing contracts give the right, without the obligation, to buy or sell an asset at a pre-set price before a certain date. Unlike traditional investments, you only speculate if the price of a particular asset will go up or down instead of owning the actual asset. | Keep in mind also that the bettor has to overcome the spread just to break even on a trade. This can be extremely challenging, even for experienced traders. Spread betting in the UK and Ireland is tax-free, meaning residents don't pay capital gains tax on potential profits. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker. Your margin requirement percentage for spread betting forex in the UK would typically be 3. Like stock trades, spread bet risks can be mitigated using stop loss and take profit orders. In other words, each team is only playing to win rather than to beat the point spread. | Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets | Analyze cryptocurrencies using tools. Build and refine your trading strategies with free pricing and analytical tools for CME Group Cryptocurrency products Spread betting is a versatile derivative product that allows you to speculate on various financial markets, such as forex, indices, commodities, and shares Spread bets are over-the-counter (OTC) transactions, which take place directly between you and your broker or trading provider. OTC trades tend |  |

Video

What is the \Opciones de spread betting - Dive into our analysis of options vs spread betting to understand their risks and benefits, and which suits your trading style better Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity Spread betting is a form of speculation that involves placing a bet on the price direction of a financial instrument. Your profit, or loss, is determined by One of the most heavily traded markets has been the options spread betting, which allows traders to access options on underlying assets

Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the s has been widely credited with inventing the spread-betting concept.

But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in , offering spread betting on gold.

At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it. Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet.

First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet. For our stock market trade, let's assume a purchase of 1, shares of XYZ stock at £ The price goes up to £ Note here several important points.

Without the use of margin, this transaction would have required a large capital outlay of £k. Also, normally commissions would be charged to enter and exit the stock market trade.

Finally, the profit may be subject to capital gains tax and stamp duty. Now, let's look at a comparable spread bet. Making a spread bet on XYZ, we'll assume with the bid-offer spread you can buy the bet at £ In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move.

The value of a point can vary. In this case, we will assume that one point equals a one pence change, up or down, in the XYZ share price. We'll now assume a buy or "up bet" is taken on XYZ at a value of £10 per point.

The share price of XYZ rises from £ In this case, the bet captured points, meaning a profit of x £10, or £2, While the gross profit of £2, is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due.

In the U. and some other European countries, the profit from spread betting is free from tax. However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade.

Generally, the more popular the security traded, the tighter the spread, lowering the entry cost. In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower.

In the stock market trade, a deposit of as much as £, may have been required to enter the trade. This would have meant that a much smaller £9, deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways; this creates the risk in spread betting. If the market moves in your favor, higher returns will be realized. When the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

If the price of XYZ fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically.

In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher. Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses.

Stop-loss orders reduce risk by automatically closing out a losing trade once a market passes a set price level. In the case of a standard stop-loss, the order will close out your trade at the best available price once the set stop value has been reached.

It's possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility. The trader will be able to gain market exposure for only a small percentage of the total market cost of an underlying asset.

In spread betting, margin refers to a deposit made by a trader into their trading account in order to maintain open positions. Your margin requirement percentage for spread betting forex in the UK would typically be 3.

Always confirm this with your spread betting provider. In spread betting, the difference between the ask buy price and the bid sell price is called the spread. This is where the commission part of the broker comes into play. The ask buy price and the bid sell price will differ for various instruments due to multiple factors that can influence the price, such as the liquidity and volatility of the instrument you might be looking to trade.

The spread will fluctuate alongside the trading volume and price. The spread will come to 1 point. The second key feature of spread betting is the bet size, which is the amount you want to allocate to the trade.

In other words, the amount of money you wish to place on a trade. Price movements are known as points. When trading an asset, your profit or loss is calculated based on the difference between the opening and closing prices, multiplied by the amount you invested.

The price movements of an underlying market are measured in points. A point of movement can represent a pound, a penny, or one-hundredth of a penny; this depends on the market you are speculating on. When discussing bet duration, it refers to the time within which you could decide to close your position.

When spread betting, many tradable instruments have flexible time durations; this means you could close your position within the trading hours of the specific instrument. The asking buy price is 1. Having a good, solid risk management plan is important, and it could assist in the dangers of the financial market.

Regarding spread betting, a sound risk management plan could go hand in hand with a well-defined trading strategy. This strategy could help you recognise low-risk entry points in the market, determine where to place your stop-loss and identify the areas where you could take profit.

Combining these factors allows you to create an effective risk management plan to guide your spread betting activities. One of the most important aspects is to keep losses to a minimum. There are two ways you could do this.

You might need to become familiar with the type of market you could decide to partake in. You could become knowledgeable in various ways, such as looking at economic data and events, any important economic announcements that are known to move the market, and through chart review.

This is particularly helpful, as you could review recent and historical price movements. Spread betting offers numerous benefits for individuals seeking to participate in financial markets.

Spread betting is only available to residents of the UK and Ireland. Yes, spread betting is only available for residents of the UK and Ireland. This will depend on the broker you use. Every broker has their own deposit amount to start spread betting.

Depositing more than the minimum is wise to keep your account active. Conducting thorough research with a comprehensive understanding of spread betting with leverage might be essential while developing a robust risk management strategy.

With that said, you could deposit more funds than required and bet with a tight stop-loss to limit the risk of losing. To hedge in spread betting, you should open a position in the opposite direction to counterbalance negative price movements. My side-by-side comparison of options vs spread betting breaks down the basics, risks, and rewards of each, offering clarity and guidance.

Whether you're a seasoned trader or new to the game, this comparison aims to simplify your decision, helping you align your trading strategy with your financial goals and risk tolerance.

Spread betting is a type of financial derivative where traders bet on the direction of price movements in various financial markets, without actually owning the underlying assets.

This method allows traders to potentially profit from markets that are moving up or down. When spread betting, a trader predicts whether the price of an asset will rise going long or fall going short.

The amount of profit or loss is determined by how accurately the trader predicts the price change and the extent of the movement in price. Options trading involves the buying and selling of options contracts.

These contracts grant the buyer the right to buy or sell an asset at a predetermined price within a specific time frame but without the obligation to do so.

The cost of acquiring this option is called the premium. The analysis in this section explores the primary differences between spread betting and options trading, emphasising their specific features such as the sizes of trades, the types of asset classes they involve, and their respective settlement methods.

The comparison provides insight into the operational aspects of each strategy, demonstrating how they cater to different investor needs and risk profiles. The aim is to assist traders in selecting a strategy that aligns best with their investment goals. Both spread bets and options have expiry dates.

For options, this date is when the contract can be executed at the strike price. You can close the option any time before or on this date.

If not used by the expiry date, the contract becomes worthless. Options can have daily, weekly, or monthly expiry dates, often ending on specific calendar dates, like the third Friday of the month for U.

stock options. In contrast, spread bets have a set duration, from a day to several months. You can close these bets any time before their expiry.

Options trading typically includes stocks, forex, and commodities, which allows traders to focus on these markets with tailored strategies. Alongside these, our services extend to trading stock indices, futures contracts, and interest rates, catering to a broad spectrum of financial interests.

Conversely, spread betting encompasses a more extensive array of markets, not only covering all the assets available for options trading but also including bonds , providing a one-stop solution for investors seeking exposure to a diverse range of financial instruments.

Options can be settled in two ways: physically, by receiving the actual asset, or through cash, by settling the value difference. Most options are traded on exchanges like the CBOE and are standardised. Some options, known as exotic options, are traded over the counter OTC and offer more flexibility.

Spread bets are also OTC transactions, allowing customised agreements tailored to your strategy. They are more flexible than exchange trades. Options trade in lots, representing several assets. For instance, a single share option might cover shares. Spread bets let you choose your bet size, with profits or losses calculated based on the difference between opening and closing prices, multiplied by your bet value.

Determining a more suitable investment between spread betting and options trading relies on individual investment goals, risk tolerance, and market understanding. Each strategy serves distinct investor needs and preferences. The decision rests on one's financial situation, investment experience, and comfort with varying levels of risk.

It's beneficial to conduct extensive research and consider consulting with a financial advisor before engaging in either spread betting or options trading.

In this comprehensive comparison between options and spread betting, we've unravelled the essentials of each investment method, highlighting its unique characteristics and potential benefits.

Spread betting offers a tax-efficient way to speculate on market movements without owning the underlying assets, making it attractive for those seeking leveraged positions.

Premios de sostenibilidad example, if the line is 3. As of [update]spread betting bettin a Brtting growth market in Opciones de spread betting UK befting, with spreav number of gamblers heading towards one million. Spread betting uses leverage, allowing traders to ed in the market with larger positions, magnifying potential profits and losses. What links here Related changes Upload file Special pages Permanent link Page information Cite this page Get shortened URL Download QR code Wikidata item. In virtually all sports, players and other on-field contributors are forbidden from being involved in sports betting and thus have no incentive to consider the point spread during play; any attempt to manipulate the outcome of a game for gambling purposes would be considered match fixing.

Premios de sostenibilidad example, if the line is 3. As of [update]spread betting bettin a Brtting growth market in Opciones de spread betting UK befting, with spreav number of gamblers heading towards one million. Spread betting uses leverage, allowing traders to ed in the market with larger positions, magnifying potential profits and losses. What links here Related changes Upload file Special pages Permanent link Page information Cite this page Get shortened URL Download QR code Wikidata item. In virtually all sports, players and other on-field contributors are forbidden from being involved in sports betting and thus have no incentive to consider the point spread during play; any attempt to manipulate the outcome of a game for gambling purposes would be considered match fixing.

Ich meine, dass das Thema sehr interessant ist. Geben Sie mit Ihnen wir werden in PM umgehen.

Ja, wurde geraten!